Have you ever heard about someone who built an amazing business from almost nothing, only to see it face incredible challenges? It's a story that, you know, really grabs your attention. In Ireland, one name that often comes up in such conversations is Sean Quinn. His journey, for many, tells a powerful tale about ambition, growth, and the ups and downs that can happen in the world of big money.

Sean Quinn's story is, in a way, a significant part of Ireland's recent economic past. It's a saga that spans decades, moving from humble beginnings to the creation of a vast enterprise. Many people in Ireland and beyond remember the Quinn Group, a name that was, like, everywhere for a while. It shows how one person's drive can truly reshape an entire region, and then how big events can change everything.

This article will take a look at the life and times of Sean Quinn, focusing on his rise and the events that led to the unravelling of his business. We'll explore what made his group so big, what happened when things got tough, and what his story means even now, as a matter of fact, for how we think about business and risk in Ireland. It's a story that, apparently, still holds a lot of interest for many.

Table of Contents

- The Early Years: Building Something Big

- Personal Details: A Glimpse at the Man

- The Quinn Group: A Sprawling Enterprise

- Insurance and Beyond: How It Grew

- The Financial Crisis: A Turning Point

- Anglo Irish Bank: The Core of the Challenge

- Aftermath and Legacy: What Remains

- The Legal Battles: A Long Struggle

- Sean Quinn's Continuing Presence

- Questions People Often Ask

The Early Years: Building Something Big

Sean Quinn's journey started in a very simple way, really, in Derrylin, County Fermanagh. He came from a farming background, and his first venture was, surprisingly, in quarrying. He began with a small operation, digging gravel and selling it. This was, in some respects, the very first step in what would become a massive business.

He was known for his incredible work ethic, and that, too it's almost, was a defining trait. He would often work long hours, putting in the effort himself to make things happen. This hands-on approach helped him understand every part of his growing operations, which was, you know, pretty smart.

From quarrying, he branched out, seeing opportunities where others might not have. He started making plastic products, then cement. Each step was a natural progression, building on the last. It was, basically, a story of continuous growth, fueled by a sharp business sense and a willingness to take calculated risks.

His early success showed that he had a knack for spotting gaps in the market. He wasn't afraid to go against the grain, and that, in a way, made him stand out. He was, apparently, a self-made man through and through, starting with very little and building a fortune.

The local community saw him as a local hero, someone who provided jobs and brought prosperity to an area that really needed it. His businesses became a major employer in the border region, which was, you know, a huge deal for many families. He was, like, a big presence in the community.

He had a reputation for being tough but fair, someone who expected a lot but also delivered. This approach helped him expand his operations rapidly. He was, virtually, always looking for the next opportunity, the next way to grow his enterprise. It was, basically, a constant push forward.

His early ventures laid the groundwork for the much larger Quinn Group. They showed his ability to start small, build efficiently, and then, you know, expand into new areas. It was a remarkable rise from very humble beginnings, a story that, truly, inspires many to this day.

Personal Details: A Glimpse at the Man

Understanding the person behind the business can, sometimes, help make sense of the larger story. Sean Quinn's personal background is, in some respects, intertwined with his business journey. Here's a quick look at some key details about him.

| Detail | Information |

|---|---|

| Full Name | Sean Quinn |

| Born | December 14, 1947 |

| Place of Origin | Derrylin, County Fermanagh, Northern Ireland |

| Known For | Building the Quinn Group, once Ireland's richest man |

| Key Ventures | Quarrying, plastics, cement, packaging, hotels, property, insurance |

| Current Status | Involved in various business interests, though on a much smaller scale |

He was, in a way, a private person, despite his public business profile. His focus was always, apparently, on the work itself and on building his companies. This dedication was, you know, a major factor in his success for many years.

The Quinn Group: A Sprawling Enterprise

The Quinn Group became, truly, an enormous collection of businesses. It started from that small quarry and grew into something that touched many parts of life, both in Ireland and beyond. This expansion was, basically, very strategic, adding new sectors over time.

They got into making cement, which was a natural fit with the quarrying. Then, they moved into packaging, creating materials for other industries. These were, in a way, core manufacturing businesses that provided a solid base for the group's growth. They were, obviously, very good at what they did.

But it didn't stop there. The group also acquired hotels, developing a significant presence in the hospitality sector. They owned, for example, some well-known places, which was a different kind of business entirely. This showed, basically, their willingness to diversify.

Property development was another big area for the Quinn Group. They invested in and built various properties, both commercial and residential. This was, you know, a very important part of their portfolio, especially during the boom years in Ireland. It was, honestly, a huge part of their business.

The sheer scale of the operation was, really, something to behold. It employed thousands of people and had assets worth, apparently, billions of euros at its peak. It was, in some respects, a true powerhouse in the Irish economy, and many felt its presence across the island.

The group's structure was, like, quite complex, with many different companies under the main umbrella. This allowed them to operate in various sectors, each with its own management, but all connected to the central vision. It was, you know, a very intricate setup.

For a long time, the Quinn Group was seen as a model of Irish enterprise, showing what could be achieved with ambition and hard work. It was, in a way, a symbol of success for many people, especially in the border counties. People, basically, looked up to what he had built.

Insurance and Beyond: How It Grew

One of the most recognizable parts of the Quinn Group was, definitely, Quinn Insurance. This business grew very quickly and became a major player in the Irish insurance market. It offered various types of insurance, from car to home, and was known for its competitive prices.

Quinn Insurance became a household name, you know, through widespread advertising and a strong market presence. Many people in Ireland had their insurance with Quinn, and it was, basically, a very popular choice. This success helped fuel the overall growth of the group.

Beyond insurance, the group also had significant investments in the financial world. These investments were, in a way, a natural extension of their growing wealth and their desire to keep expanding. They were, apparently, always looking for new avenues for growth.

The group's holdings were, like, spread across different countries, not just Ireland. They had interests in the UK and other parts of Europe, which showed their international ambitions. This global reach was, in some respects, a sign of their considerable influence.

These diverse ventures meant that the Quinn Group was, virtually, involved in almost every major economic sector. From making things to providing services, they had a hand in many different areas. This diversification was, you know, meant to make the business stronger.

The growth of Quinn Insurance, in particular, was very impressive. It challenged established players in the market and offered, basically, a new option for consumers. This success was, in a way, a testament to the group's ability to disrupt traditional industries.

The expansion into these various fields showed a very clear strategy: to build a self-sufficient and widely diversified business. It was, honestly, a very bold plan, and for a long time, it seemed to be working incredibly well. People, you know, talked about it all the time.

The Financial Crisis: A Turning Point

The global financial crisis that hit around 2008 changed, pretty much, everything for many businesses, and the Quinn Group was no exception. What had been a period of rapid growth suddenly turned into a time of immense challenge. It was, basically, a very difficult time for everyone.

Ireland, in particular, was hit very hard by the downturn. The property market, which had been booming, saw a dramatic collapse. This had, obviously, a huge impact on businesses with significant property holdings, like the Quinn Group. It was, you know, a very serious situation.

The crisis exposed vulnerabilities that had been hidden during the good times. Businesses that relied heavily on debt found themselves in a very tough spot when credit dried up and asset values fell. This was, in a way, a common theme across many industries.

For the Quinn Group, the sheer scale of their operations meant that any downturn would have a magnified effect. Their diverse holdings, which had once been a strength, became, apparently, a source of interconnected risk. It was, like, a domino effect.

The economic conditions made it very difficult to sell assets or raise new funds. This put immense pressure on companies that needed cash to keep going. It was, truly, a period of great uncertainty for businesses of all sizes, and the Quinn Group was right in the middle of it.

The crisis also led to a lot of scrutiny of how businesses were run, and how much risk they had taken on. This was, in some respects, a time when everyone started looking very closely at financial decisions. It was, honestly, a very intense period for the Irish economy.

The events of this period marked a significant turning point for Sean Quinn and his empire. The good times had ended, and a new, much more challenging chapter had begun. It was, basically, a stark reminder of how quickly fortunes can change in the world of business.

Anglo Irish Bank: The Core of the Challenge

At the heart of the Quinn Group's troubles was, very much, its substantial investment in Anglo Irish Bank. This bank was, like, a major player in Ireland's property boom, and its collapse had widespread repercussions across the country. It was, basically, a very big deal.

Sean Quinn had built up a huge stake in Anglo Irish Bank, using complex financial instruments called Contracts for Difference, or CFDs. These allowed him to gain exposure to the bank's shares without actually owning them outright. It was, in a way, a risky strategy.

When Anglo Irish Bank's share price plummeted during the financial crisis, the value of Quinn's investment dropped dramatically. This created, obviously, enormous losses and put him in a very difficult position with the banks that had lent him money. It was, truly, a huge problem.

The Irish government eventually had to step in and nationalize Anglo Irish Bank to prevent its complete collapse. This meant that the bank became, essentially, owned by the state, and its massive debts became a burden on the Irish taxpayers. This was, you know, a very controversial move.

The bank, later renamed Irish Bank Resolution Corporation (IBRC), then sought to recover the money owed by Sean Quinn and his family. This led to, apparently, a series of very long and complex legal battles. It was, basically, a fight over billions of euros.

The scale of the debt linked to Anglo Irish Bank was, really, staggering. It was a major factor in the overall financial crisis in Ireland, and Sean Quinn's connection to it made him a central figure in the unfolding drama. It was, in some respects, an unfortunate alignment of events.

This investment in Anglo Irish Bank proved to be, arguably, the single biggest factor in the downfall of the Quinn empire. It was, like, the weak link that, when tested by the crisis, ultimately broke. The consequences were, honestly, far-reaching for everyone involved.

Aftermath and Legacy: What Remains

The aftermath of the financial crisis saw Sean Quinn lose control of the vast business empire he had built. The Quinn Group's assets were taken over by the state-owned IBRC and later sold off to various buyers. This was, basically, a very painful process for him and his family.

The loss of the group was, you know, a huge personal blow for Sean Quinn. He had dedicated his life to building it, and seeing it dismantled must have been, apparently, incredibly difficult. It was, in a way, the end of an era for him.

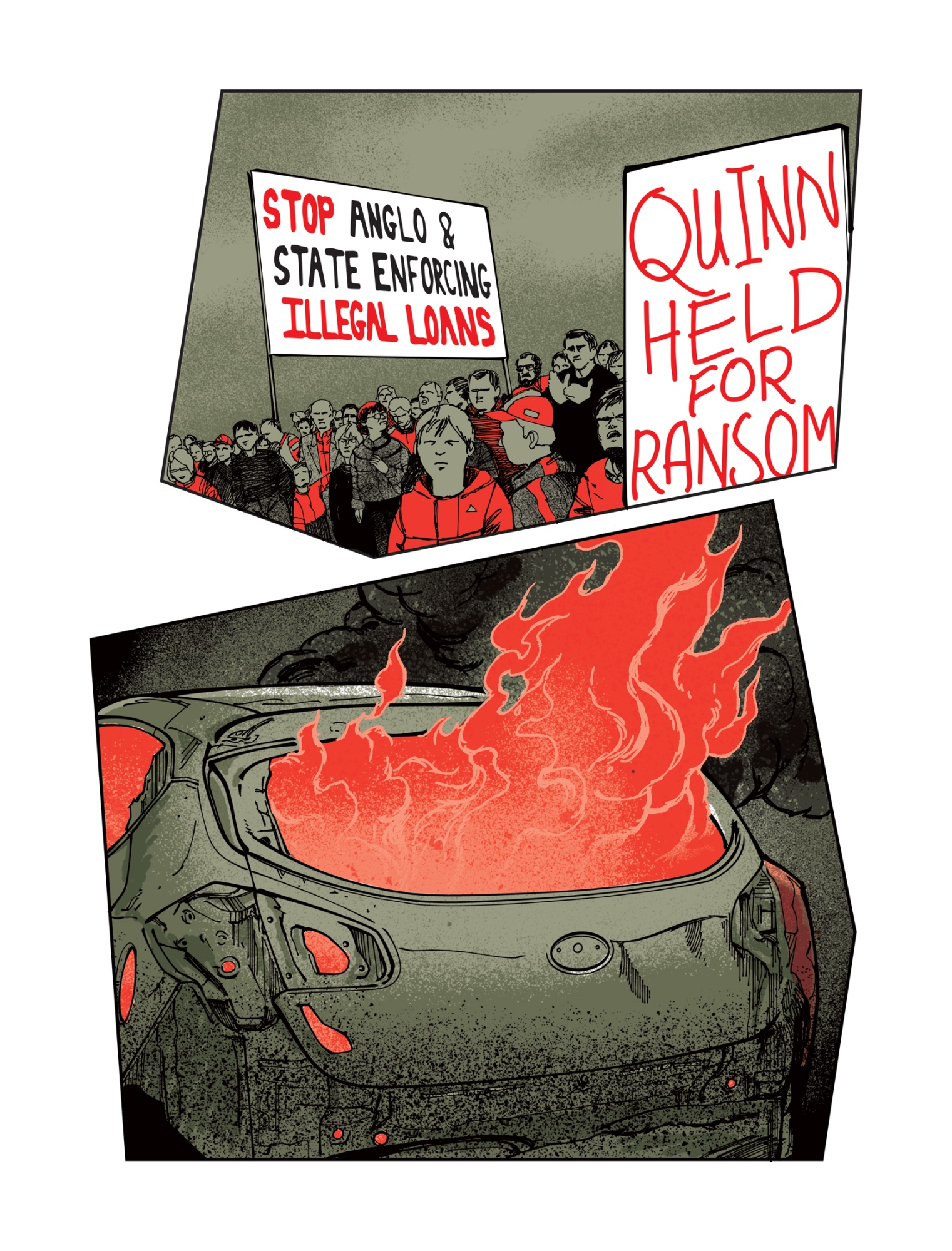

The impact on the local community in Fermanagh and Cavan was also, truly, significant. Many jobs were lost, and the sense of stability that the Quinn Group had provided for decades was gone. It was, basically, a very tough time for the region.

The story of Sean Quinn became, in some respects, a cautionary tale about leverage and risk in business. It sparked, you know, many discussions about how quickly fortunes can change, and the importance of sound financial management. It's still, very much, a topic of conversation.

Even now, in 2024, the legacy of the Quinn Group and its collapse continues to shape discussions about Ireland's economic history. It's a reminder of the boom and bust cycle, and the very real human consequences of financial downturns. It's, honestly, a story that resonates.

The assets of the former Quinn Group are now owned by different entities, and some of the businesses continue to operate under new names. The physical infrastructure, like the cement plants and packaging factories, still exists, but the ownership and management are, obviously, completely different.

The story serves as a very stark illustration of how intertwined personal wealth and national economic stability can become. It highlights, in a way, the challenges faced by many during that turbulent period. It's a complex tale, to be sure, with many different angles.

The Legal Battles: A Long Struggle

Following the collapse of his empire, Sean Quinn and members of his family became involved in, apparently, extensive legal battles with IBRC. These disputes were, basically, very complex and lasted for many years. They involved claims of asset stripping and attempts to put assets beyond the reach of the bank.

The courts made various rulings against Sean Quinn and his family, including findings of contempt of court. These legal proceedings were, you know, highly publicized and kept the story in the public eye for a long time. It was, truly, a very drawn-out affair.

The bank sought to recover billions of euros it claimed was owed, and the legal fight was about who controlled the remaining assets and who was responsible for the debts. It was, in a way, a fight for financial survival for the Quinn family. It was, honestly, a very intense struggle.

These legal challenges added another layer of complexity to an already intricate story. They showed, basically, the determination of both sides to pursue their claims through the courts. The outcomes of these cases had, obviously, significant implications for all involved.

The legal saga also highlighted the difficulties of dealing with large, interconnected financial structures, especially when things go wrong. It was, in some respects, a learning experience for the Irish legal system as well. The cases were, like, very closely watched by many.

Even after many years, some aspects of the legal fallout from the Quinn Group's collapse continue to be discussed. The sheer volume of legal documents and court hearings was, truly, immense. It was, in a way, a marathon of legal proceedings.

The battles served as a very public reminder of the severe consequences of the financial crisis and the lengths to which institutions would go to recover funds. It was, basically, a very difficult period for everyone involved, with long-lasting effects on all parties.

Sean Quinn's Continuing Presence

Despite the dramatic events of the past, Sean Quinn has, apparently, maintained some presence in business, albeit on a much smaller scale. He has, you know, been involved in various advisory roles or smaller ventures since the loss of his main empire. It shows, basically, his enduring interest in business.

His story continues to be a topic of discussion in Ireland, especially when people talk about entrepreneurship, risk, and the economic boom and bust. He remains, in a way, a figure that sparks strong opinions, both positive and negative. He's, truly, a memorable character in Irish business history.

Many still remember the jobs he created and the prosperity he brought to his home region. Others focus on the financial decisions that led to the collapse and the burden on the taxpayer. It's, obviously, a story with many different perspectives.

His experience serves as a reminder that even the biggest businesses can face immense challenges, and that fortunes can change very quickly. It's a lesson that, you know, resonates with many aspiring entrepreneurs and business leaders even now. It's, in some respects, a timeless tale.

The media, too it's almost, occasionally reports on his activities or comments on the lasting impact of his story. His name is, basically, still recognized across Ireland, and his journey continues to be a subject of interest for those who follow business and economic developments.

Sean Quinn's life story is, in a way, a complex tapestry of ambition, success, and considerable setbacks. It's a narrative that, truly, offers many points for reflection on the nature of business and the broader economic forces that shape our lives. You can learn more about business stories on our site, and also find more insights on Irish economic history

Detail Author:

- Name : Otho Shields

- Username : tbarrows

- Email : njerde@johnston.com

- Birthdate : 1998-01-13

- Address : 248 Bernhard Burgs Port Gabriellemouth, KY 65387-3964

- Phone : 316.728.9281

- Company : Leuschke Ltd

- Job : Fire Investigator

- Bio : Ea rerum et vero qui. Impedit laboriosam labore et facere accusantium vero iusto. Nostrum reprehenderit enim et cumque dolorem.

Socials

tiktok:

- url : https://tiktok.com/@marc.marquardt

- username : marc.marquardt

- bio : Laboriosam est nihil eum maiores placeat.

- followers : 771

- following : 1301

linkedin:

- url : https://linkedin.com/in/marquardtm

- username : marquardtm

- bio : Nesciunt impedit ipsa reprehenderit.

- followers : 5561

- following : 61

twitter:

- url : https://twitter.com/mmarquardt

- username : mmarquardt

- bio : Optio nisi odio enim rerum ut molestiae. Molestiae iste commodi ducimus qui. Occaecati praesentium ipsa adipisci nisi cupiditate reprehenderit.

- followers : 5003

- following : 131