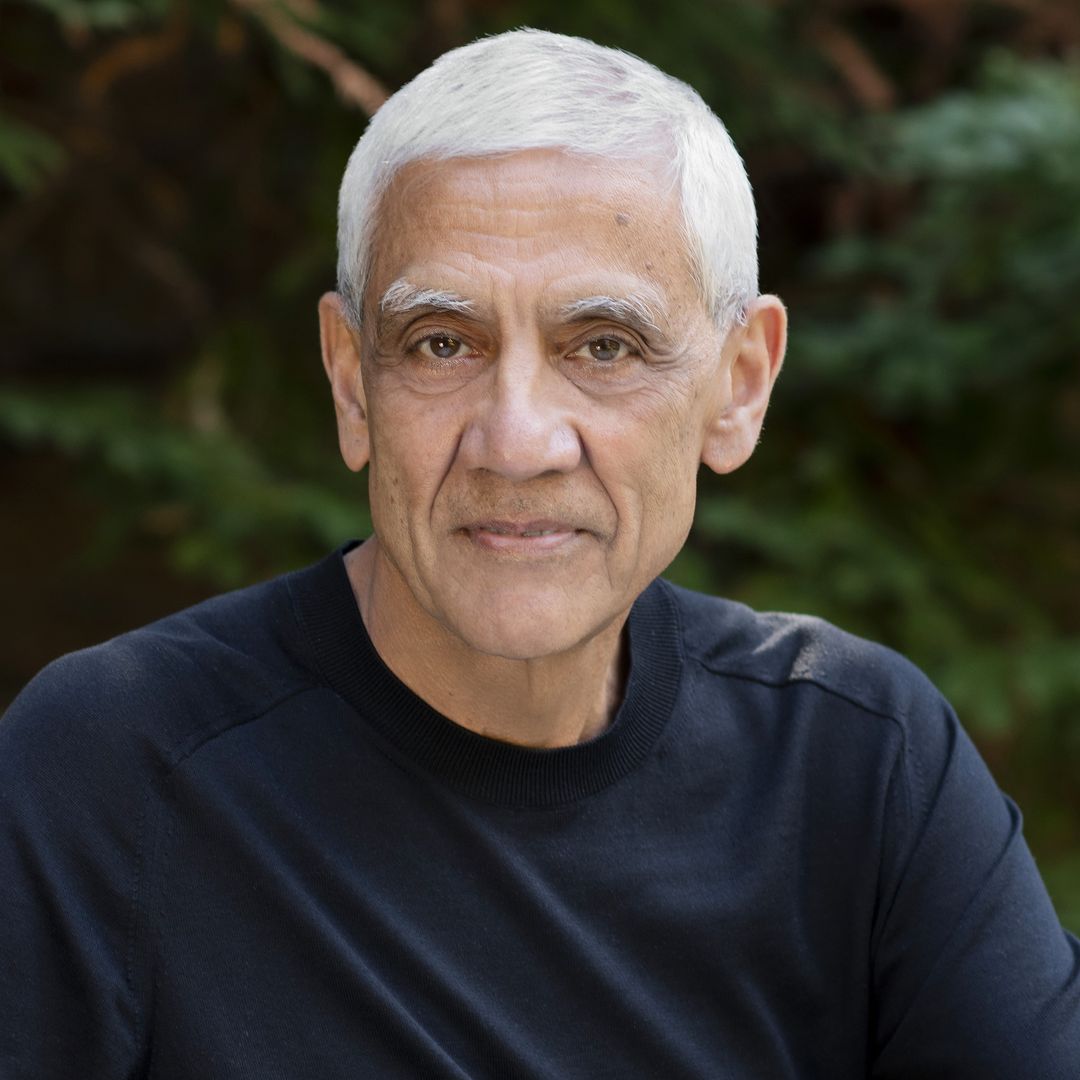

Vinod Khosla, a name that echoes through the halls of Silicon Valley, truly stands as a titan in the world of venture capital and technology. People often wonder about the financial standing of such influential figures, and for very good reason. Learning about Vinod Khosla’s net worth offers more than just a number; it provides a glimpse into the impact of strategic foresight, daring investments, and a commitment to shaping the future. It's about understanding how innovation can lead to immense value creation, and that, is that, a story many find quite compelling.

For those curious about the architects of modern industry, understanding how someone like Vinod Khosla built his fortune can be genuinely enlightening. His journey, from co-founding a groundbreaking tech company to becoming a leading investor in disruptive technologies, really shows a path of consistent innovation. We’ll look at the key moments and decisions that have contributed to his impressive financial standing, providing a clear picture of his economic influence.

This article explores the various facets of Vinod Khosla’s wealth, detailing his career milestones, investment philosophy, and the ventures that have defined his financial success. It aims to give you a comprehensive picture of his contributions and how they tie into his overall net worth, so, it's a deep dive into what makes him a financial powerhouse.

Table of Contents

- Biography and Early Life

- Personal Details and Bio Data

- The Sun Microsystems Era

- The Rise of Khosla Ventures

- Investment Philosophy and Key Sectors

- Notable Investments and Exits

- Philanthropy and Impact

- Understanding Vinod Khosla's Net Worth

- Frequently Asked Questions

Biography and Early Life

Vinod Khosla’s story begins in New Delhi, India, where he grew up with a deep fascination for technology and entrepreneurship. He read about Intel in Electronic Engineering Times when he was just fourteen, and that, kind of, sparked his early interest. This early exposure to the tech world set him on a path that would eventually lead him to the heart of Silicon Valley, and it's a journey that really shows dedication.

He pursued his higher education with a clear vision, earning a Bachelor of Technology in Electrical Engineering from the Indian Institute of Technology Delhi. Following this, he moved to the United States for further studies, securing a Master of Science in Biomedical Engineering from Carnegie Mellon University. This academic background, apparently, provided a strong foundation for his future endeavors.

His academic pursuits did not stop there; he also attended the Stanford Graduate School of Business, where he earned his Master of Business Administration. This blend of engineering and business acumen would prove invaluable in his career, shaping his ability to not only understand complex technologies but also to identify their market potential. It was, in some respects, a perfect blend for what was to come.

Personal Details and Bio Data

Here is a quick look at some personal details about Vinod Khosla, providing a snapshot of his background and key attributes. This information, you know, helps paint a fuller picture of the person behind the wealth.

| Full Name | Vinod Khosla |

| Date of Birth | January 28, 1955 |

| Place of Birth | New Delhi, India |

| Nationality | American (Indian-born) |

| Education |

|

| Occupation | Venture Capitalist, Entrepreneur |

| Known For | Co-founder of Sun Microsystems, Founder of Khosla Ventures |

| Spouse | Neeru Khosla |

The Sun Microsystems Era

One of the foundational pillars of Vinod Khosla’s wealth creation was his role as a co-founder of Sun Microsystems in 1982. This company, which he helped start with Scott McNealy, Bill Joy, and Andy Bechtolsheim, quickly became a major player in the computing world. Sun Microsystems, basically, developed and sold computers, software, and services.

Khosla served as the first CEO of Sun Microsystems, guiding the company through its critical early years. His leadership was crucial in establishing Sun as a force in the workstation market, offering powerful systems that were particularly popular among engineers and scientists. This period, in fact, laid much of the groundwork for his future success.

The company’s initial public offering (IPO) in 1986 marked a significant financial milestone for its founders, including Khosla. While he left Sun Microsystems shortly after its IPO to pursue venture capital, his stake in the company and the subsequent growth of Sun’s value contributed a substantial amount to his personal fortune. It was, you know, a very strong start.

The Rise of Khosla Ventures

After his impactful tenure at Sun Microsystems and a period at Kleiner Perkins Caufield & Byers, Vinod Khosla decided to forge his own path in the venture capital world. In 2004, he founded Khosla Ventures, a firm that would quickly become synonymous with bold, often unconventional, investments. This move, apparently, solidified his reputation as a visionary investor.

Khosla Ventures was established with a clear mission: to invest in companies that aim to solve large, global problems using technological breakthroughs. The firm's focus often leans towards what some might call "science experiments" rather than typical software plays, looking for deep technology that could truly change industries. It's a rather unique approach in the VC space.

Under Khosla’s guidance, the firm has backed a wide array of ventures, from clean energy and sustainable agriculture to artificial intelligence and healthcare. His willingness to take significant risks on nascent technologies has defined Khosla Ventures’ investment strategy, and that, pretty much, sets them apart.

Investment Philosophy and Key Sectors

Vinod Khosla’s investment philosophy is characterized by a deep belief in the power of technology to address fundamental societal challenges. He often speaks about the need for "black swan" investments—those with a small chance of success but an enormous potential payoff if they do work. This thinking, you know, guides many of his firm’s choices.

He is known for his contrarian views, often investing in areas that mainstream venture capitalists might shy away from due to perceived risk or long development cycles. Khosla believes that truly transformative ideas often look crazy at first, and that, is what he seeks out. This approach has led him to champion sectors like clean technology, which was a tough sell for many years.

Key sectors where Khosla Ventures has made significant inroads include:

- Clean Energy: Investing in renewable energy sources, energy storage, and efficient resource use.

- Sustainable Agriculture: Supporting companies that aim to revolutionize food production, reduce waste, and improve sustainability.

- Artificial Intelligence: Backing firms developing advanced AI applications across various industries.

- Healthcare: Focusing on innovative biotechnologies and health tech solutions that could drastically improve medical outcomes.

- Materials Science: Exploring new materials with properties that can enable entirely new products or processes.

His dedication to these areas reflects a commitment to impact beyond just financial returns, though the financial returns have been substantial. He’s looking for companies that, basically, change the world for the better.

Notable Investments and Exits

Khosla Ventures has a portfolio filled with companies that have either achieved remarkable success or are poised to do so. Some of the firm’s most recognized investments have significantly contributed to Vinod Khosla’s net worth through successful exits or substantial valuations. Square, the financial services company, is one such example that really stands out.

Another high-profile investment is in Impossible Foods, a company at the forefront of plant-based meat alternatives. This investment aligns perfectly with Khosla’s interest in sustainable solutions for global problems, and it’s, pretty much, changing how people think about food. The growth and market acceptance of Impossible Foods have added considerable value to Khosla Ventures’ holdings.

While many of his clean tech investments faced challenges in their early days, some have shown promise or achieved breakthroughs over time. His willingness to stay the course, even when others might pull back, has been a defining characteristic. This long-term perspective, arguably, is a key to his success.

Other notable companies in the Khosla Ventures portfolio, past and present, include GitLab, Affirm, and various biotech firms. The sheer breadth and depth of these investments underscore his diverse interests and his knack for identifying future trends. He truly has a knack for spotting what's next, you know.

Philanthropy and Impact

Beyond his venture capital endeavors, Vinod Khosla and his wife, Neeru Khosla, are active philanthropists. They established the Khosla Family Foundation, which focuses on various causes, particularly in education and poverty alleviation. Their giving, in fact, extends to many different areas.

Neeru Khosla, in particular, has been instrumental in educational initiatives, co-founding the CK-12 Foundation, which provides free and customizable K-12 educational materials. This commitment to open access education reflects a desire to democratize knowledge and opportunity. It’s a very impactful effort, really.

Vinod Khosla also frequently engages in public discourse on technology, policy, and the future of innovation. He often shares his insights at conferences and through various media, influencing conversations around critical global issues. His voice, basically, carries a lot of weight in these discussions.

His broader impact extends to advocating for policies that support technological innovation and sustainable development. He believes that technology, when applied thoughtfully, can solve many of the world's most pressing problems, and that, is a message he often repeats.

Understanding Vinod Khosla's Net Worth

Estimating the precise net worth of an individual like Vinod Khosla is always an approximation, as much of his wealth is tied up in private investments, venture capital funds, and fluctuating market valuations. However, various financial publications, such as Forbes, regularly provide estimates based on public records, fund sizes, and known investments. As of late 2024, his net worth is generally reported to be in the multi-billion dollar range, reflecting his sustained success.

His wealth comes from several distinct sources. The initial gains from Sun Microsystems provided a significant base. Following that, his work as a general partner at Kleiner Perkins Caufield & Byers further added to his financial standing through successful investments during that period. But the largest component of his current wealth, arguably, stems from the returns generated by Khosla Ventures.

The value of Khosla Ventures’ portfolio companies, whether through successful IPOs, acquisitions, or private valuations, directly contributes to his personal wealth. The firm's focus on high-risk, high-reward ventures means that while some investments may not pan out, the few that succeed spectacularly can generate enormous returns. This model, you know, is typical of top-tier venture capital firms.

It’s important to remember that net worth figures are dynamic and can change with market conditions, new investments, and divestitures. However, Vinod Khosla’s consistent presence on lists of the world’s wealthiest individuals underscores his enduring influence and financial acumen. He truly has built a lasting legacy, and that, is something to consider.

Frequently Asked Questions

What is Vinod Khosla's primary source of wealth?

Vinod Khosla’s primary source of wealth comes from his highly successful career in venture capital, particularly through his firm, Khosla Ventures. Before that, his role as a co-founder of Sun Microsystems also provided a significant initial boost to his fortune. So, it’s a mix of entrepreneurship and smart investing, you know, over many years.

What kind of companies does Khosla Ventures invest in?

Khosla Ventures typically invests in companies that aim to use technology to solve big, global problems. They often focus on what they call "science experiments," which are deep technology ventures in areas like clean energy, sustainable agriculture, artificial intelligence, and healthcare. They are, basically, looking for disruptive innovations that can change entire industries.

Is Vinod Khosla involved in philanthropy?

Yes, Vinod Khosla and his wife, Neeru Khosla, are actively involved in philanthropy through the Khosla Family Foundation. Their efforts focus on various causes, including education and poverty alleviation. Neeru Khosla, for instance, co-founded the CK-12 Foundation, which provides free educational materials, and that, is a very impactful initiative.

Learn more about venture capital on our site, and link to this page understanding his investment strategy.

For more insights into the world of tech billionaires and their impact on innovation, you might explore articles from reputable business publications like Forbes, which often track the financial standing of such figures. It’s a good way to stay current, you know, with these big names.

Detail Author:

- Name : Carmel Greenfelder

- Username : schultz.tracy

- Email : deanna.schultz@ankunding.com

- Birthdate : 1989-04-14

- Address : 517 Noemie Bypass East Gino, TN 36748

- Phone : +1.413.472.8552

- Company : Johnson PLC

- Job : CTO

- Bio : Et corporis explicabo et est vel. Ex possimus expedita et sed. Praesentium laboriosam exercitationem culpa voluptatem. Sunt quia est aut sit non.

Socials

linkedin:

- url : https://linkedin.com/in/heloise9280

- username : heloise9280

- bio : Qui praesentium doloribus optio impedit qui.

- followers : 5767

- following : 1092

twitter:

- url : https://twitter.com/streichh

- username : streichh

- bio : Eum quia ut qui corporis voluptatem modi. Voluptatem quia consectetur est nesciunt incidunt. Nemo expedita perferendis nam iure voluptatem quia.

- followers : 5015

- following : 1764

instagram:

- url : https://instagram.com/streich1984

- username : streich1984

- bio : Est unde et dolor vero nemo. Ea dolor provident in. Assumenda at sit nisi eaque.

- followers : 6325

- following : 1356

facebook:

- url : https://facebook.com/heloise1268

- username : heloise1268

- bio : Neque perspiciatis cum qui tempore sit ipsam quis.

- followers : 972

- following : 1818

tiktok:

- url : https://tiktok.com/@heloise_official

- username : heloise_official

- bio : Ut non aut libero ut consequatur vero aperiam commodi.

- followers : 4651

- following : 1480