Many people, it's almost, find themselves wondering about the financial standing of prominent public figures, and when the name Dr. Muhammad Yunus comes up, that curiosity can be especially strong. Here is a man known globally for his pioneering work in microfinance, a Nobel Peace Prize recipient who has dedicated his life to alleviating poverty. So, it's quite natural to ask: what exactly is Dr. Muhammad Yunus's net worth?

His work with Grameen Bank, after all, fundamentally changed how we think about banking for the poor, showing that even tiny loans could make a huge difference. This innovative approach, which empowers millions, really makes you think about the intersection of social impact and personal finances. It's a bit different from your typical CEO or celebrity wealth discussion, you know?

This article will look into what "net worth" might mean for someone like Dr. Yunus, considering his unique path and commitment to social good. We'll explore his background, the principles guiding his work, and how his financial life likely reflects his dedication to a world without poverty. It's about understanding the man, his mission, and the financial picture that comes with it, in some respects.

Table of Contents

- Biography of Dr. Muhammad Yunus

- Personal Details and Bio Data

- The Philosophy Behind His Work

- Understanding "Net Worth" for a Social Innovator

- Grameen Bank and Its Financial Model

- Sources of Income and Philanthropy

- Frequently Asked Questions About Dr. Muhammad Yunus's Finances

- Final Thoughts

Biography of Dr. Muhammad Yunus

Dr. Muhammad Yunus was born in 1940 in Bathua, a village in Bangladesh, which was then part of British India. His early life was pretty much shaped by a strong academic bent and a desire to make a difference. He studied economics at Dhaka University and later earned his Ph.D. in economics from Vanderbilt University in the United States, in fact.

Upon returning to Bangladesh, he joined Chittagong University as a professor. It was during the devastating famine of 1974 that he began to question the traditional economic theories he taught, seeing how little they helped the truly impoverished. This was a pivotal moment, you know, leading him to think differently about how to help people directly.

His groundbreaking idea came from a simple observation: even very small amounts of money could transform lives if given to the right people without traditional collateral. This led to the experimental lending of small sums to villagers, an initiative that eventually grew into the Grameen Bank in 1983. This institution, which means "Rural Bank" in Bengali, basically pioneered the concept of microcredit, offering small loans to impoverished individuals, mostly women, to help them start their own businesses. It's quite a story of how a simple idea can grow into something so impactful, as a matter of fact.

For his efforts in poverty alleviation through microcredit, Dr. Yunus, along with Grameen Bank, was awarded the Nobel Peace Prize in 2006. This recognition brought his work to a global stage, inspiring similar initiatives around the world. He's often called the "banker to the poor," and it's a title he very much earned through decades of dedicated work.

Personal Details and Bio Data

Understanding a person often begins with a few key facts. Here’s a quick look at some personal details for Dr. Muhammad Yunus:

| Full Name | Muhammad Yunus |

| Born | June 28, 1940 |

| Nationality | Bangladeshi |

| Education | Ph.D. in Economics, Vanderbilt University |

| Known For | Pioneering microcredit, founding Grameen Bank, social business concept |

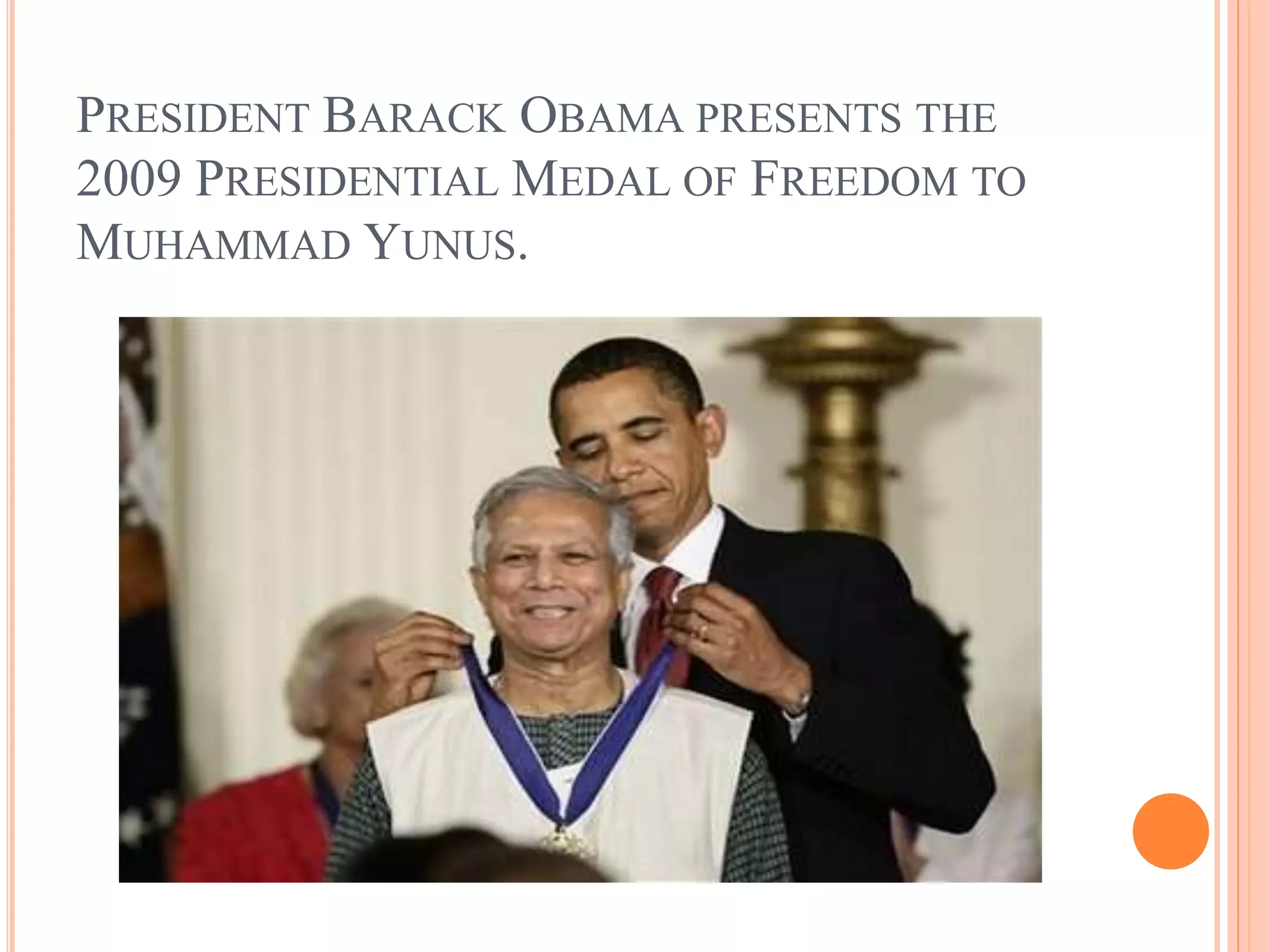

| Awards | Nobel Peace Prize (2006), Presidential Medal of Freedom (2009), Congressional Gold Medal (2013) |

The Philosophy Behind His Work

The core of Dr. Yunus's work, and indeed his life, revolves around a powerful philosophy: poverty is not a natural state but an artificial construct that can be eradicated. He believes that every human being, regardless of their economic status, possesses inherent entrepreneurial potential. It's a very optimistic view, isn't it?

His "social business" concept is a prime example of this philosophy in action. Unlike traditional businesses that aim to maximize profit for shareholders, a social business aims to solve a social problem. Any profits generated are reinvested into the business itself to further its social mission, rather than being distributed to owners. This means the idea of personal enrichment, like, isn't the driving force at all.

He often speaks about "putting poverty in a museum," a phrase that really captures his vision for a world free from want. This isn't just about charity; it's about creating sustainable systems that empower people to lift themselves out of poverty through their own efforts. His work is basically about creating opportunities, not handouts, which is a key distinction, you know.

This deep commitment to social change means that his personal financial standing is, in a way, secondary to his broader goals. His focus has always been on the collective good, on creating a financial system that serves the poor, not on accumulating personal wealth. It's a different kind of success he's after, really.

Understanding "Net Worth" for a Social Innovator

When we talk about the "net worth" of someone like Dr. Muhammad Yunus, it's quite different from discussing the net worth of, say, a tech mogul or a real estate magnate. For most public figures, net worth is calculated by subtracting liabilities (debts) from assets (property, investments, cash). But for a social innovator like Dr. Yunus, this calculation is a bit more nuanced, apparently.

His primary contribution and "wealth" are tied to the social institutions he built and the ideas he championed. He doesn't own Grameen Bank in the traditional sense; it's owned by its borrowers. So, while the bank itself is a massive financial entity, its success does not translate directly into personal wealth for Dr. Yunus. This is a very important distinction, you see.

Moreover, individuals dedicated to humanitarian causes often structure their financial lives to reflect their values. Any income they receive, perhaps from speaking engagements, book royalties, or awards, is often channeled back into their work or related philanthropic efforts. It's not about building a personal fortune, but about fueling a mission, naturally.

So, when you consider Dr. Muhammad Yunus's net worth, it's less about a specific dollar figure in a bank account and more about the incredible social capital he has built, the millions of lives he has touched, and the global movement he inspired. His "wealth" is arguably measured in impact, not just personal assets, in fact.

Grameen Bank and Its Financial Model

To truly understand Dr. Yunus's financial context, we need to look at Grameen Bank. This institution is not a typical commercial bank. It was founded on the principle that credit is a human right, and its structure reflects this. The bank is owned by its borrowers, meaning the millions of women who take out loans from Grameen are also its shareholders. This is a pretty unique model, you know.

Grameen Bank operates on a self-sustaining model. It charges interest on its loans, but these interest rates are designed to cover operational costs and allow for reinvestment, not to generate large profits for external shareholders. The idea is to be financially viable while serving its social mission. It's a delicate balance, but one they've managed to maintain for decades, in fact.

Dr. Yunus, as the founder, played a crucial role in establishing its vision and guiding its growth. However, he does not personally profit from the bank's operations in the way a CEO of a publicly traded company might. His role was about creating a system, not extracting personal gain from it. This is a key aspect of his commitment to social business, you know.

The bank's success is measured by its outreach and its ability to help people escape poverty, not by its stock price or shareholder dividends. This fundamental difference means that any discussion of Dr. Yunus's "net worth" must acknowledge that the vast financial resources of Grameen Bank are not his personal assets. They belong to the community of borrowers, in a way.

Sources of Income and Philanthropy

While Dr. Yunus does not personally benefit from Grameen Bank's profits, he does have other sources of income, as most prominent public figures do. These can include earnings from books he has authored, speaking engagements, and potentially consulting fees. For example, his books like "Banker to the Poor" and "A World of Three Zeros" have been widely read and translated, generating royalties. These are very much legitimate income streams, you know.

Similarly, as a Nobel Peace Prize laureate and a respected global voice, he is often invited to speak at conferences, universities, and events around the world. These speaking engagements typically come with honoraria. It's quite common for individuals of his stature to receive significant fees for such appearances, in fact.

However, consistent with his philosophy, it's widely understood that a substantial portion of any personal income he receives is likely directed towards his various social initiatives and philanthropic endeavors. He is involved with numerous organizations beyond Grameen Bank that promote social business, education, and healthcare for the poor. So, it's not about accumulating personal wealth, but rather about using any resources he gains to further his mission, basically.

His personal financial picture is, therefore, probably characterized by a modest lifestyle relative to his global influence, with a strong emphasis on reinvesting any personal earnings back into the causes he champions. It's a testament to his unwavering commitment to his life's work, truly.

Frequently Asked Questions About Dr. Muhammad Yunus's Finances

Is Dr. Muhammad Yunus wealthy?

The term "wealthy" can mean different things to different people, of course. If we define wealth as accumulating significant personal assets for individual gain, then Dr. Muhammad Yunus is not considered wealthy in that traditional sense. His life's work has been dedicated to poverty alleviation, and his financial philosophy centers on social business, where profits are reinvested for social good rather than personal enrichment. His influence and impact are immense, but his personal financial holdings are not the focus of his work, in some respects.

Does Dr. Yunus profit from Grameen Bank?

No, Dr. Yunus does not personally profit from Grameen Bank in the way a traditional shareholder or CEO would. Grameen Bank is owned by its borrowers, and its financial model is designed to be self-sustaining, covering operational costs and allowing for reinvestment into its mission of poverty alleviation. Any surplus funds are used to expand the bank's services or reduce interest rates for its clients, not to enrich its founder. This is a very clear distinction in the bank's structure, you know.

How does a Nobel Peace Prize winner manage money?

While specific details of a Nobel Peace Prize winner's personal financial management are private, it's common for individuals like Dr. Yunus to channel their income from various sources (like book royalties, speaking fees, and award money) into their philanthropic work and social initiatives. For someone deeply committed to a cause, personal finances often become a tool to further that mission rather than a means for personal accumulation. It's a different approach to money, actually, where impact often takes precedence over personal gain.

Final Thoughts

When we explore the concept of "dr muhammad yunus net worth," it becomes clear that his financial standing is not defined by typical measures of personal wealth. His life's work, characterized by the creation of Grameen Bank and the pioneering of microcredit, has been about empowering others and eradicating poverty, not about accumulating personal riches. His true "net worth" lies in the millions of lives he has touched and the global movement for social business he inspired. It's a legacy built on impact, not on personal fortune, you know.

His journey serves as a powerful reminder that wealth can be measured in many ways, and for some, the greatest riches are found in contributing to the well-being of humanity. To learn more about microfinance initiatives and their global impact, you can explore our resources. And if you're interested in the broader topic of social entrepreneurship, we have a wealth of information available on this site, too.

Detail Author:

- Name : Crystel Satterfield

- Username : kdietrich

- Email : timmothy32@bode.org

- Birthdate : 1983-05-06

- Address : 337 Amanda Harbor Suite 009 East Jeanie, MO 83744-7516

- Phone : 872.605.4124

- Company : Gleason-Considine

- Job : Paper Goods Machine Operator

- Bio : Ratione dolorum et ipsam facere. Placeat error omnis quisquam accusamus. Ut deleniti quam qui consequuntur qui ut.

Socials

twitter:

- url : https://twitter.com/ezequiel2229

- username : ezequiel2229

- bio : Praesentium voluptatem dolor aliquid veritatis est. Esse hic culpa iure quis quos sequi odio. Natus qui dolorum neque libero dolor sequi.

- followers : 4062

- following : 2462

tiktok:

- url : https://tiktok.com/@ebert2011

- username : ebert2011

- bio : Soluta eos quo illo atque et. Consequatur illum ea ut et.

- followers : 5735

- following : 2005

facebook:

- url : https://facebook.com/ezequielebert

- username : ezequielebert

- bio : Quaerat asperiores repudiandae autem voluptas qui corrupti.

- followers : 1119

- following : 2568

instagram:

- url : https://instagram.com/ebert1990

- username : ebert1990

- bio : Est autem facere quia. Ea natus consequatur amet. Est enim aspernatur autem perspiciatis magni.

- followers : 832

- following : 858